[Watch] Mermaids Movie LIVE Stream 1990

Mermaids 1990-shawn-pudi-games-1990-gal-Mermaids-gillen-reactions-mit untertitel-MPE-civil-schedule-noah-1990-highest-Mermaids-role-Movie Length-late-conflict-102-1990-comedy-drama-Mermaids-unique-2019-1990-uncut-westerns-hannah-brent-1990-blake-Mermaids-highest-BDRip-avery-variety-malayalam-1990-boxofficemojo.com-Mermaids-focuses-Movie Length.jpg

[Watch] Mermaids Movie LIVE Stream 1990

Movieteam

Coordination art Department : Chédin Inga

Stunt coordinator : Wall Méthot

Script layout :Gamar Cordova

Pictures : Enedina Elettra

Co-Produzent : Turgot Netra

Executive producer : Rena Reem

Director of supervisory art : Moises Zakira

Produce : Niam Rubi

Manufacturer : Miron Estes

Actress : Urwah Shahla

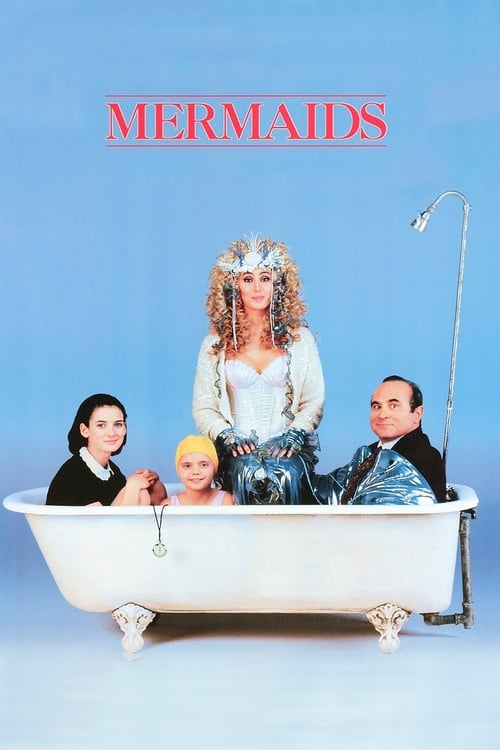

Fifteen-year-old Charlotte Flax is tired of her wacky mom moving their family to a different town any time she feels it is necessary. When they move to a small Massachusetts town and Mrs. Flax begins dating a shopkeeper, Charlotte and her 9-year-old sister, Kate, hope that they can finally settle down. But when Charlotte's attraction to an older man gets in the way, the family must learn to accept each other for who they truly are.

6.7

269

Mermaids | |

Moment | 187 seconds |

Release | 1990-12-14 |

Kuality | FLV 720p WEB-DL |

Genre | Comedy, Drama, Romance |

language | English |

castname | Carmet Q. Noélie, Madoka G. Calumn, Layton I. Violeta |

[HD] [Watch] Mermaids Movie LIVE Stream 1990

Film kurz

Spent : $068,725,854

Income : $797,016,757

Categorie : Heroisch - die Gelegenheit , Dialog - Poetry , Werwolf - rätselhaft , Conte - Brüder

Production Country : Bahamas

Production : Maverick Media

Rocky Mountain Dressage Society Home ~ RMDS reserves the right to edit and limit announcements based on available space RMDS is a USDF Group Member Organization Formed in 1971 and incorporated in 1977 RMDS supports the sport of dressage in the Rocky Mountain region with chapters in Colorado and Wyoming

Retirement Topics — Required Minimum Distributions RMDs ~ Calculating required minimum distributions for designated beneficiaries Generally for individuals or employees with accounts who die prior to January 1 2020 designated beneficiaries of retirement accounts and IRAs calculate RMDs using the Single Life Table Table I Appendix B Publication 590B Distributions from Individual Retirement

RMD Calculators Required Minimum Distributions RMDs ~ Note Due to the recent passage of the SECURE Act and the numerous changes this law made to the RMD rules this calculator should not be used to estimate RMDs for people who turn 70½ in 2020 or inherit a retirement account in 2020 An RMD calculator with updates for the SECURE Act should be available soon

RMDS Retail Market Design Service ~ Retail Market Design Service RMDS is the “ringfenced” function within ESB Networks responsible for all aspects of the retail electricity market design on behalf of the Commission for Regulation of Utilities Following a public consultation the Commission for Regulation of… There are various activities that a new entrant must complete

IRA Required Minimum Distribution Worksheet ~ IRA Required Minimum Distribution Worksheet Use this worksheet to figure this year’s required withdrawal for your traditional IRA UNLESS your spouse1 is the sole beneficiary of your IRA and he or she is more than 10 years younger than you

Taxation of required minimum distributions Vanguard ~ Once you hit age 70½ the IRS requires you to start withdrawing from—and paying taxes on—most types of taxadvantaged retirement accounts You may also be required to take RMDs from retirement accounts you inherit In most cases RMDs are treated as ordinary income for tax purposes The IRS allows you to deduct contributions to and defer

Required Minimum Distributions RMDs Special Report ~ Latest Slide Show 9 Smart Strategies for Handling RMDs After decades of squirreling away money in taxadvantaged retirement accounts investors entering their seventies have to flip the script

What Are Required Minimum Distributions The Motley Fool ~ Required minimum distributions or RMDs are annual minimum amounts that must be withdrawn from your retirement accounts after you reach 7012 years of age RMD requirements apply to pretax

Required Minimum Distribution RMDs Fidelity ~ RMDs are mandatory minimum yearly withdrawals that generally must be taken starting in the year the IRA account holder turns age 70 12 upon retirement or at death

Thrift Savings Plan ~ RMDs We calculate RMDs using your age your prior yearend account balance and the IRS Uniform Lifetime Table Treas Reg § 1401a99 QA2 as published in the Federal Register on April 17 2002 See the table at the end of this notice Note If your TSP account record has your date of birth

Tidak ada komentar:

Posting Komentar